UK Conveyancing Process for Buyers Explained (2025)

Updated: July 2025

Conveyancing is the legal process of transferring property ownership from seller to buyer in the UK, involving a series of checks, contracts, and payments to ensure the sale is legitimate and secure. It starts once your offer is accepted and ends when you receive the keys, with your solicitor or conveyancer handling all the legal work, paperwork, and coordination between parties.

Key Takeaways:

- The process includes legal checks, property searches, and drafting contracts to protect both parties.

- Choosing an experienced solicitor helps avoid delays, hidden issues, and unnecessary costs.

- On average, conveyancing takes 8–12 weeks from offer to completion.

What is the Conveyancing Process

Conveyancing is the legal process of transferring ownership of a property from seller to buyer, handled by a solicitor or licensed conveyancer. It involves preparing and reviewing contracts, conducting legal checks, and ensuring that all money and documents are exchanged safely.

Despite its importance, only 40% of UK adults fully understand it, according to HomeOwners Alliance.

Related Read: The conveyancing process for sellers explained

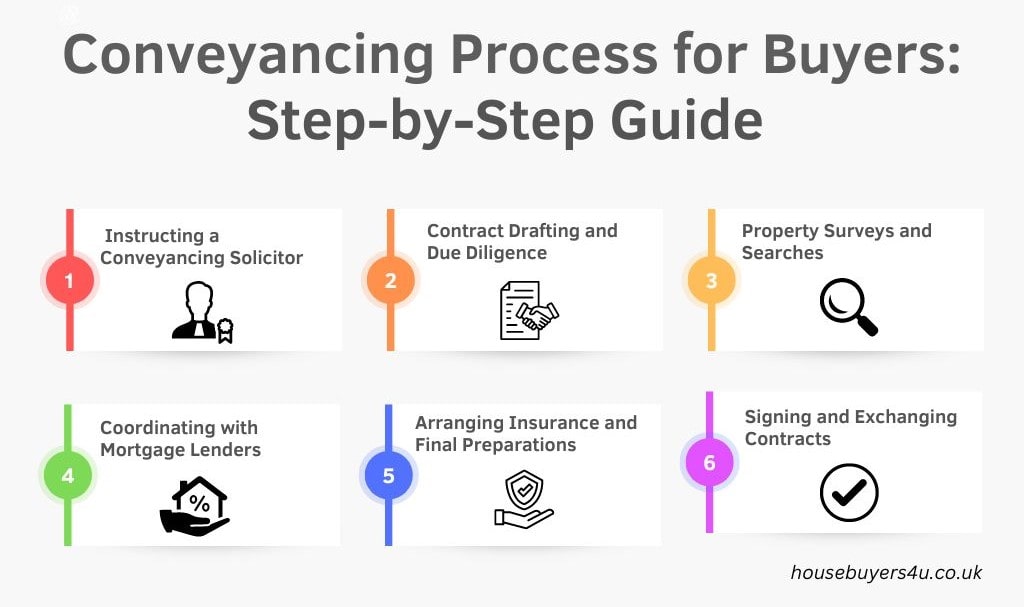

Step-by-Step Guide: Conveyancing Process for Buyers Explained

After working with a real estate agent and identifying your financing options, the conveyancing process can begin. Here are the steps involved:

1) Instructing a Conveyancing Solicitor

Research and choose a solicitor with experience in property law and clear communication. Compare quotes, then formally instruct your chosen solicitor by signing a client care form and providing details of your purchase.

Working with a good conveyancer who is knowledgeable and communicates well is important for a better experience. In a survey conducted with 2,000 UK adults, 31% said they want frequent communication with their conveyancer. Moreover, 21% wanted a clearer explanation of the legal process and the issues that arose.

Expert Comment from our in house property expert Paul Gibbens:

"I’ve seen too many buyers trip up because they picked the cheapest solicitor without checking their track record. In my experience, paying a bit more for a solicitor who’s genuinely responsive saves you weeks of frustration and can stop a deal falling through at the last minute."

2) Contract Drafting and Due Diligence

Your solicitor prepares a draft contract covering price, completion date, and special terms. They carry out legal checks, including reviewing title deeds and raising any queries with the seller’s solicitor.

3) Property Surveys and Searches

Your solicitor orders searches (local authority, environmental, drainage) to uncover issues like planning breaches or flood risk.

4) Coordinating with Mortgage Lenders

Your solicitor liaises with your lender, checks mortgage conditions, and ensures the mortgage deed is ready and funds are available for completion. Delays here are common, so respond promptly to requests for information.

5) Arranging Insurance and Final Preparations

Arrange home insurance to start from the exchange date. Check all survey issues are resolved and confirm your finances are in place.

6) Signing and Exchanging Contracts

On completion day, your solicitor transfers the balance to the seller’s solicitor, the keys are released, and you take ownership.

Conveyancing Costs Explained

Understanding the costs involved in conveyancing helps you budget effectively. Here’s a detailed breakdown of typical conveyancing fees and other associated costs:

-

Legal fees:

-

Solicitors or licensed conveyancers charge a fee for their services, typically ranging from £800 to £1,500, depending on the complexity of the transaction and property value. This fee covers the legal work required to transfer ownership of the property.

-

-

Search fees:

-

Various searches are conducted to uncover any potential issues with the property. These include local authority searches, environmental searches, and water and drainage searches. Search fees usually range from £250 to £300.

-

-

Land registry fees:

-

These fees are paid to the Land Registry to update the property’s title. The cost depends on the property price and whether the application is made online or by paper. Fees range from £20 to £1,105.

-

-

Stamp Duty Land Tax (SDLT):

-

SDLT is a tax on properties over a certain price threshold. The amount varies based on the property price and whether you are a first-time buyer, moving house, or purchasing an additional property. Use the government’s SDLT calculator to determine your exact liability.

-

-

Bank transfer fees:

-

Solicitors charge a fee for transferring the funds to complete the property purchase. This fee, known as a Telegraphic Transfer Fee or CHAPS fee, typically ranges from £35 to £50.

-

-

Additional costs:

-

Other potential costs include charges for obtaining a mortgage, such as arrangement fees and valuation fees, which can range from £150 to £1,500 depending on the lender and mortgage product.

-

HB4U Seller Savings (Real Example)

Common Conveyancing Problems & How to Avoid Them

Even straightforward property purchases can hit unexpected snags. Here are the top issues buyers face and how to dodge them:

-

Delayed paperwork from sellers: Chasing missing documents can stall everything. Solution: Make sure your seller has all forms, certificates, and warranties ready before you start.

-

Slow searches and enquiries: Waiting for local searches or slow replies to questions drags out the process. Solution: Use a proactive solicitor who follows up and pushes for fast responses.

-

Mortgage approval delays: Mortgage hold-ups are a leading cause of missed deadlines. Solution: Get your mortgage agreement in principle early and have your paperwork ready for full approval.

Avoid Conveyancing Hassles & Sell Direct to Housebuyers4u

Why deal with paperwork delays and legal surprises? With house buyers like us, you skip the headaches:

-

We buy your property directly no need for estate agents or long chains.

-

All solicitor and legal fees paid by us.

-

Guaranteed quick sale, even if you’ve hit issues with paperwork, searches, or buyer delays.

Get a genuine cash offer from our expert team and see how easy selling can be.