Lease Option Sales Explained (Sellers & Buyers)

Updated: October 2025

Lease options combine elements of renting and buying, allowing a buyer to rent a property now and purchase it later at an agreed price. For sellers, it offers flexibility, income, and the chance to achieve a higher sale price. For buyers, it provides time to secure a mortgage and test living in the property before making a commitment.

Key Takeaways:

- A lease option lets a buyer rent now and buy later at a pre-agreed price.

- Sellers can earn rent and secure a potential future sale without listing on the open market.

- Ideal when flexibility, time, or higher sale value matter more than a fast cash sale.

What Is a Lease Option Sale?

A lease-option sale is an agreement in which a buyer rents a property for a set period, with the right, but not the obligation, to purchase it at the end of the term. It bridges the gap between renting and owning, giving buyers time to improve their credit or savings while giving sellers a regular income and a potential future sale.

Key elements include:

-

Option fee: A non-refundable upfront payment securing the buyer’s right to purchase (usually 2–5% of the price).

-

Lease term: Typically 1–3 years.

-

Purchase price: Fixed at the start, even if the market changes.

-

Monthly rent: Often slightly above market rate, sometimes with a portion credited toward the purchase.

When Lease Options Might Be the Smart Choice

While not the right fit for everyone, lease options offer unique advantages in specific situations. Consider this path if:

-

You want a higher price: Buyers needing time to secure finance may pay more than cash buyers.

-

You want ongoing income: Rent provides a steady return while waiting for purchase completion.

-

You need flexibility: Ideal if the market is slow or your plans might change.

-

Your home is hard to sell: Unique, high-maintenance, or niche properties often find success through lease-option buyers.

-

Buyer wants to ‘try before they buy’: Helps hesitant buyers test the property before fully committing.

Expert insight from Paul Gibbens, Housebuyers4u:

“Lease options can work well in niche situations where both sides need time, but they also carry risks. If you’re the seller, always protect yourself legally. Agree on clear terms upfront for repairs, payments, and timeframes, because once the lease begins, you’re effectively tied into a long-term commitment.”

How a Lease Option Sale Works (Step by Step)

-

Agreement: The seller and buyer agree on the purchase price, lease term, monthly rent, and option fee that secures the buyer’s right to purchase later.

-

Lease Period: The buyer moves in as a tenant and pays rent. Some agreements include rent credits, in which a portion of the rent is applied toward the future purchase.

-

Decision Point: Before the lease ends, the buyer decides whether to complete the purchase at the agreed price. If they don’t, the seller keeps the option fee and rental income.

This setup offers flexibility for both parties: the buyer can walk away if circumstances change, while the seller continues to benefit from consistent income throughout the lease.

A Simple Breakdown of a Lease Agreement

- Agreed Purchase Price: £275,000

- Lease Term: 2 years

- Option Fee: £5,500 (2% of the purchase price)

- Monthly Rent: £1,400

- Rent Credit: 50% of each rent payment goes towards the down payment if the buyer purchases.

If the buyer decides to purchase:

- Their £5,500 option fee is applied to the down payment.

- Over two years, they accumulate £16,800 in rent credits (50% of their rent).

- Their total down payment contribution is £22,300.

- They secure a traditional mortgage for the remaining £252,700 to complete the purchase.

These figures are approximate. Lease option terms and property values can vary based on location and individual agreements.

It's essential to consult with a solicitor specialising in lease options to ensure the agreement is fair and legally sound.

How Lease Option Sales Compare in 2025 (Real Data Table)

Lease-option sales can vary widely depending on the agreement and the buyer's reliability. Based on Housebuyers4u’s market research and seller data, here’s how these deals typically perform in the UK property market:

| Category | Typical Lease Option Result | Average Across HB4U Seller Data (2025) | Market Insight |

|---|---|---|---|

| Average Lease Term | 1–3 years | 2.2 years | Most sellers wait over 24 months for completion. |

| Buyer Completion Rate | 58–65% | 61% | Around 4 in 10 buyers never complete the purchase. |

| Average Option Fee | 2–5% of property value | 3.2% | Usually between £4,000–£9,000 depending on price. |

| Monthly Rent Range | £1,100–£1,600 | £1,350 average | Often slightly above local market rent. |

| Rent Credits Applied | 30–60% of rent | 45% typical | Varies by contract, not always guaranteed. |

| Common Fall-Through Causes | Finance issues, valuation drops, buyer withdrawal | 73% finance-related | Most failed completions happen when buyers can’t get a mortgage. |

Pros and Cons for Sellers and Buyers

Lease options offer potential advantages, but like any selling method, there are important considerations:

Seller Cons:

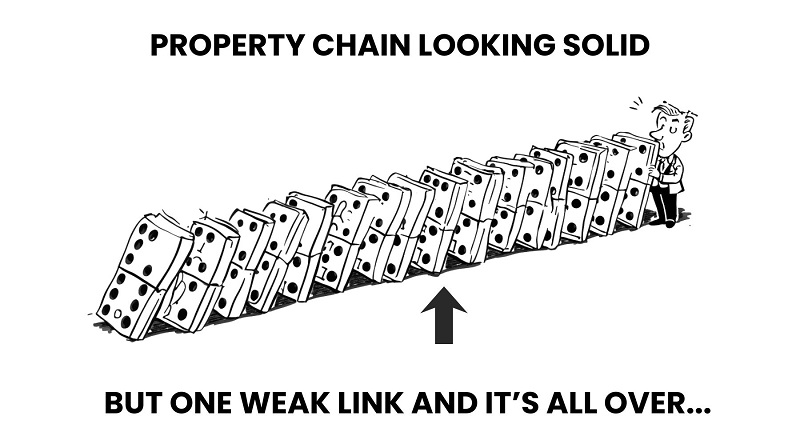

- Risk of Non-Purchase: If the buyer doesn't exercise their option, you've essentially taken your property off the market for the lease period. You'll then need to find a new buyer or re-list it.

- Repair Responsibility: Depending on the agreement, you might still be responsible for repairs during the lease. This can become costly or a point of dispute with the buyer/tenant.

- Legal Complexities: Lease option contracts can be more complex than a standard sale agreement. Poorly written agreements can lead to misunderstandings and legal problems.

Related: The legals of selling to a house buying company

Buyer's Perspective:

To give a well-rounded view, it's worth noting that lease options have both pros and cons for buyers as well.

- Buyer Pro: Time to improve credit/save, chance to "try out" the property, potential price lock-in.

- Buyer Pro: With less competition than a traditional sale, buyers might have more leverage to negotiate aspects of the lease-option agreement, such as rent or repair responsibilities.

- Buyer Con: Loss of option fee if they don't buy, rent might be above market rate, responsibility for some repairs (depending on the agreement).

- Buyer Con: Even though they're living in the property, the buyer/tenant still has less control over major renovations than a homeowner. These limitations should be outlined in the agreement.

Only about 35% of renters exercise their option to buy so it's important for both sides to understand the pros and cons!

Thinking About a Lease Option Sale? Know Your Best Route First

Lease options can sound appealing, they offer flexibility and the chance of a higher sale price but they’re not always the simplest or quickest way to sell. Many sellers find that, after weighing the risks, they really want certainty, speed, and peace of mind.

If you’re unsure whether to wait months for a buyer to decide or move on with a guaranteed sale, Housebuyers4u can help.

Why many sellers choose us instead:

-

No waiting for buyers to secure a mortgage or “decide later”

-

No legal complexity or risk of a buyer pulling out

-

Guaranteed cash sale with completion in as little as 7 days

-

No fees, no agents, no repairs required